Rule Of 40 Saas

Transaction Multiples for SaaS CompaniesEarlier this year a colleague at Scale Venture Partners, Andy Vitus, wrote an outstanding post on valuing a software company. Specifically, valuation multiples for SaaS companies initial CAGR (compounded annual growth rates). These growth rates predictably decline each year as the SaaS company matures.

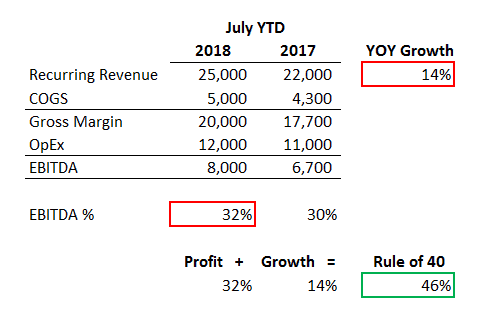

The Rule of 40% For a Healthy SaaS Company. The 40% rule is that your growth rate + your profit should add up to 40%. So, if you are growing at 20%, you should be generating a profit of 20%. If you are growing at 40%, you should be generating a 0% profit. If you are growing at 50%, you can lose 10%.

It is the expected rate of CAGR decline that then translates into what valuation multiples a SaaS m&a firm should apply when valuing a software company.Over the past several months many SaaS business owners have inaccurately referenced the article to indicate their business valuation multiples expectations when discussing exit strategies with iMerge. Therefore we thought it imperative to add some color to this post and clear up any confusion.Andy shows this chart of financial metrics (click to expand) that outlines how much revenues will grow over a five year period based on various growth decay rates (left column). The far right column is NOT a SaaS multiple for business owners to expect upon an exit. It is just the multiple of revenue expansion over a five year period. It’s necessary to keep in mind that the chart is intended to be used by early investors in SaaS companies as a general guideline. IMerge’s experience has shown that SaaS firm’s growth rate and its rate of decline vary widely. Many SaaS companies may have an initial growth rate that well exceeds 100% but finds itself pretty quickly settling down faster than a speed of the “Low Road.” Ultimately most public saas companies and private companies have found themselves within range of the growth numbers Andy depicts.

Mature Bootstrapped SaaS Companies May Need To Re-position Expected SaaS Multiples.Since many of our discussions are with mature bootstrapped SaaS firms with revenues between $10-$20 million and EBITDA of $2-$4 million we need to re-position expectations. If a SaaS firm has gone from a CAGR of 150% down to 20% in its 5th year, it is going to be difficult to convince any buyer that the business growth will exceed 100% someday again under new ownership. Those SaaS business owners that are 3 to 5 years old will want to take their most recent CAGR and look at the light blue column headed with a 0. Typically for these “mature” SaaS firms, the expansion range will be from 1.9x to 3.0x.

Meaning in 5 years the company’s revenues will be 2 to 3 times larger.Interpreting the Numbers for Cloud Based SaaS Business OwnersSo what does all this mean to cloud based SaaS business owners and the offers they are likely to see when exploring an exit. Venture capital investors are looking to get 5 to 10 times ROI on their initial investment. Therefore the sector has to be or expected to see high growth, and the tech companies will need to show its ability to get way out in front with a proprietary, high entry barrier service with lots of differentiation.

As noted, in the chart for a VC firm to see an expected 5x + return (last column), the SaaS firm’s management team will have to strive for 70% growth with no more than 10% annual growth decay. Risk Appetite of Investors in SaaS CompaniesOn the other hand, financial and strategic investors have a smaller risk appetite which means the more mature, albeit lower growth, SaaS companies can be appealing. Correspondingly, lower growth rates mean lower multiples.To determine where the mature SaaS company falls on the multiples valuation chart note the highlighted red circle. The middle column is the five-year revenue expansion rate, scroll over to the right to the Entry P/S column, and that would provide an estimate of where the SaaS business valuation lies.Lastly, as an example (horizontal red line), a five year young SaaS company is showing a current 40% CAGR. The buyer expects the annual rate of decay to be 15% per year for the next five years yielding a 2.3x revenue expansion with the 5th year CAGR being 17%.

In this case, the buyer is likely to peg the valuation multiple at 1.8x revenues.To learn specifically the cloud-based business valuation multiples for your SaaS firm, please contact us. Needless to say, if you are looking for venture capital for your SaaS company contact.

The SaaS space uses. A popular one is the Rule of 40. But what is the Rule of 40, and why is it used? What is the Rule of 40?The Rule of 40 is a growth metric calculated as Revenue Growth + Profit Margin in percentage terms. The objective is for the sum to be 40% or greater.

As an example, if your revenue growth is 50% and your profit goes down 10%, your score is 40%.In the original post from Brad Feld, revenue growth is calculated as year-over-year MRR. The figure used for profits is typically EBITDA. Why is the Rule of 40 used?Solely focusing on top line revenue growth does not look at the quality of the growth.

In other words, some growth is better than others. Revenue growth that also results in profit growth is generally superior to revenue growth that lowers profits. The Rule of 40 seeks to balance the importance of top and bottom line performance.It is important to note that the Rule of 40 was originally conceived by venture capitalists to evaluate companies at scale ($50 million in revenue), not early stage companies.

Rule Of 40 Saas In Hindi

Rule Of 40 Calculation

If you are an early stage company, you can still look at the Rule of 40. However, unit economics metrics such as churn or customer acquisition cost are more important than the Rule of 40.has more information on the Rule of 40, including graphs of how public companies stack up against this rule. Posted In Tagged In Post navigation.